Essential Strategies for Effective Debt Management During Furlough

Essential Strategies for Effective Debt Management During Furlough

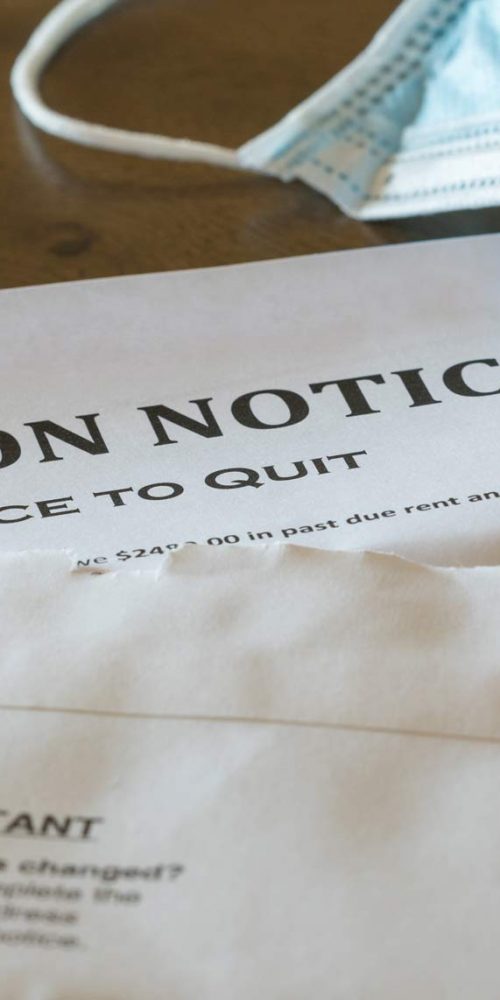

The COVID-19 pandemic has profoundly transformed the economic environment in the UK, precipitating a wave of furloughs and layoffs across various industries. Consequently, countless individuals are facing substantial financial pressures and the intimidating challenge of managing their debts while coping with reduced income. If you find yourself on furlough for an extended period, tackling your debts may seem insurmountable, especially when your earnings have dropped to 80% of your regular salary. However, by employing effective strategies, you can successfully navigate this financial terrain. This guide provides actionable insights on how to reclaim control of your finances in these trying times and work towards a path of financial recovery.

1. Create a Customized Monthly Budget That Reflects Your New Income

Begin by developing a personalized monthly budget that accurately represents your current financial situation. This budget should take into account your reduced earnings while highlighting your ability to save effectively. Dedicate time to reassess your spending habits and pinpoint areas where you can cut back on non-essential expenditures, such as entertainment, dining out, and luxury items. By redirecting these funds towards essential bills and savings, you can establish a sustainable financial framework that not only helps you manage your debts but also equips you for any future financial challenges. This disciplined strategy will empower you to take control of your financial future.

2. Identify Alternative Income Sources to Offset Your Reduced Earnings

In order to fulfill your debt repayment commitments, it's vital to seek out ways to bridge the 20% income gap. Investigate potential alternative income options, such as freelance projects or part-time employment, and contemplate cutting back on unnecessary costs by canceling seldom-used subscription services or reassessing your grocery shopping patterns. Implementing a cost-effective meal planning strategy can greatly reduce your monthly expenses. By actively seeking these additional income avenues and implementing savings strategies, you will be in a stronger position to meet your debt obligations and prevent falling behind during your furlough.

3. Investigate Debt Consolidation Loans for Simplifying Your Financial Obligations

Consider the option of applying for debt consolidation loans for those with poor credit. These financial solutions streamline your obligations by combining multiple debts into a single, more manageable monthly payment. This strategy can reduce confusion over payment dates and amounts, simplifying your financial planning process significantly. For individuals on furlough, a debt consolidation loan can provide a structured approach to managing limited income while alleviating the stress linked to juggling various payments, ultimately assisting in restoring your financial stability.

4. Strategically Outline Your Future Financial Aspirations and Security

While you navigate your current financial hurdles, it is crucial to keep your long-term goals in focus, such as purchasing a home or launching a business. Establishing these objectives can serve as a motivational force to enhance your financial standing. A debt consolidation loan can also improve your credit score, making it easier to qualify for a mortgage or business financing with favorable interest rates. By strategically planning and striving towards your financial ambitions, you can position yourself for success and achieve a higher level of financial independence in the long run.

For additional support and expert guidance on managing your finances during these challenging times, as well as understanding how <a href="https://limitsofstrategy.com/understanding-good-debt-and-bad-debt-a-clear-guide/">debt consolidation loans</a> can aid furloughed employees, feel free to reach out to Debt Consolidation Loans today.

If you are a homeowner or business owner, connect with the experts at Debt Consolidation Loans today to discover how a debt consolidation loan can enhance your financial stability and well-being.

If you believe a Debt Consolidation Loan aligns with your financial goals, do not hesitate to contact us or call 0333 577 5626. Take the critical first step towards improving your financial situation with a single, manageable monthly payment.

Explore Essential Financial Resources for Expert Guidance:

Consolidate My Medical Loan: Is It Possible?

Consolidate My Medical Loan: Is It Possible?

Can You Successfully Consolidate Your Medical Loan?

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Delayed Until March, Car Seizures Still Allowed

Important Information Regarding Evictions Postponed Until March

Get Out of Debt Quickly: Effective Strategies to Consider

Get Out of Debt Quickly: Effective Strategies to Consider

Rapidly Implement Effective Strategies to Eliminate Debt

Debt Consolidation Loans UK: Benefits and Drawbacks

Debt Consolidation Loans UK: Benefits and Drawbacks

Analyzing the Advantages and Disadvantages of Debt Consolidation Loans in the UK

Debt Consolidation Loan Calculator for Smart Financial Planning

Debt Consolidation Loan Calculator for Smart Financial Planning

Utilize Our Debt Consolidation Loan Calculator for Enhanced Financial Planning

The Article Furloughed and in Debt? Key Actions You Must Take Was Found On https://

Creating a budget that reflects a reduced income seems straightforward, but I’ve found it can be quite challenging when emotions are tied into spending habits. For instance, many people struggle with the psychological aspect of reducing expenses right when they need to feel a sense of normalcy, especially if they have families to care for.

I can really relate to what you’re saying about the emotional challenges of adjusting a budget when income decreases. It’s surprising how tightly our spending habits can be tied to our sense of stability, particularly during tough times. When families are involved, it becomes even more complex; you want to provide that sense of normalcy and assurance for those you care about.

I completely understand where you’re coming from. The emotional toll of adjusting a budget when income decreases can feel overwhelming. It’s interesting how our spending habits are so intertwined with our feelings of security. When I went through a similar experience, I really had to reevaluate what “normal” meant for my family. We found that creating new routines around budgeting—like family game nights instead of going out—helped maintain that sense of stability we all craved.

You bring up such a crucial point. The emotional side of managing a budget, especially when there’s been a shift in income, can really complicate things. It’s tough when spending habits are tied to comfort and normalcy, particularly during uncertain times.